Save money and stress less as an academic with our top budgeting app picks! See our selection of the best budgeting apps for academics.

Budgeting can be a challenge, especially for students and academic professionals, who often have limited time. However, with the rise of technology, managing finances has become much easier.

There are now numerous budgeting apps available that can help students and academics stay on top of their finances. These apps come with a range of features, from tracking expenses to creating and sticking to a budget.

We have identified 10+ best budgeting apps for academics. These apps were selected based on their user-friendliness, range of features, and ability to help users stay on top of their finances.

Whether you’re a college student or a professor, there is an app on this list that can help you keep your finances in order and reach your financial goals.

It’s important to note that while budgeting apps can be incredibly helpful, they should not be relied on as the sole solution to managing finances. Budgeting apps are a tool that can help you stay on track, but ultimately, it is up to you to make informed financial decisions and stick to a budget.

Let’s go!

Table of Contents

Key Types of Budgeting Apps

There are several key types of budgeting apps, including:

- Expense Tracking Apps: These apps help users keep track of their expenses by allowing them to categorize and track their spending. Examples include Mint, Personal Capital, and PocketGuard.

- Budgeting Apps: These apps help users create and stick to a budget by allowing them to track their income and expenses and set spending limits. Examples include YNAB (You Need a Budget), EveryDollar, and Budget Simple.

- Investment Tracking Apps: These apps help users track their investments and monitor their portfolio performance. Examples include Robinhood, Stash, and Acorns.

- Debt Management Apps: These apps help users track their debt and create a plan to pay it off. Examples include Debt Payoff Planner, Tally, and Debt Manager.

- Saving and Goal Tracking Apps: These apps help users track their savings and set goals for the future. Examples include Digit, Qapital, and Acorns Later.

3 Top Expense Tracking Apps For Academics

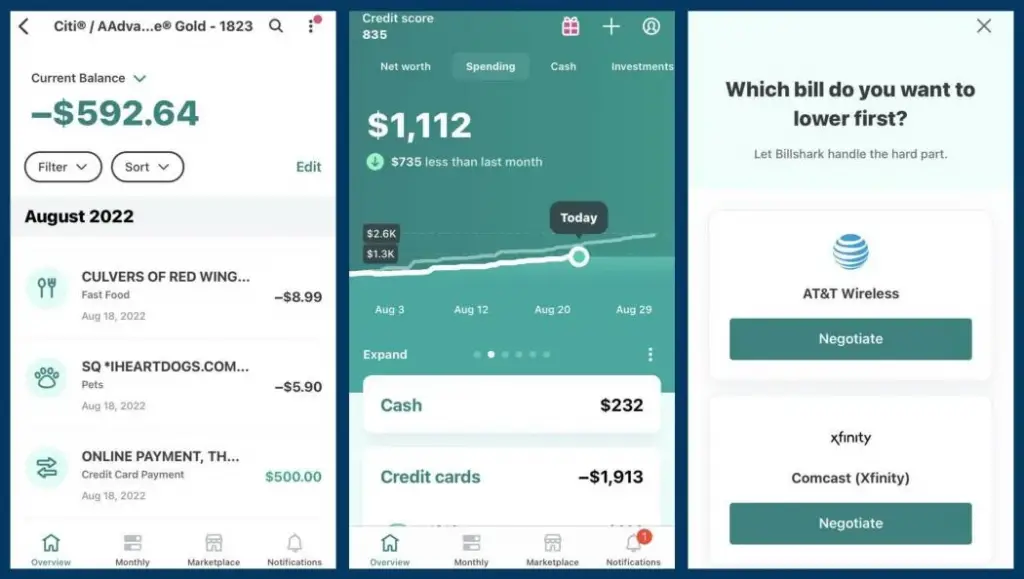

Mint – Take Charge Of Your Finances

Mint is a popular budgeting app known for its user-friendly interface and comprehensive set of features. The app allows users to connect their bank accounts, credit cards, and other financial accounts, and then tracks their spending and categorizes it into easy-to-read charts and graphs.

Mint also provides users with a personalized budget based on their spending habits and alerts them when they are close to overspending in a particular category.

Additionally, Mint offers a range of financial tools and resources, such as credit score tracking, investment tracking, and bill reminders, to help users stay on top of their finances. Overall, Mint provides a comprehensive and user-friendly experience for budgeting and managing finances.

Availability: App available for iPad, iPhone, Android, and Windows mobile devices.

👍Pros

- Easy to use

- Comprehensive features: Mint offers a range of features, including expense tracking, budgeting, credit score tracking, investment tracking, and bill reminders, all in one app

- Personalized budgeting: Mint creates a personalized budget based on users’ spending habits, helping them to stay on track and reach their financial goals

- Financial insights and resources: Mint provides users with valuable financial insights and resources, such as alerts for overspending and advice on how to improve their finances

👎Cons

- Security concerns: As with any app that requires users to connect their financial accounts, there may be concerns about the security of their personal and financial information

- Limited investment options: While Mint offers investment tracking, it may not have all the investment options that some users are looking for

💸Pricing

- Mint is a free app, and there are no hidden fees or premium features that require payment

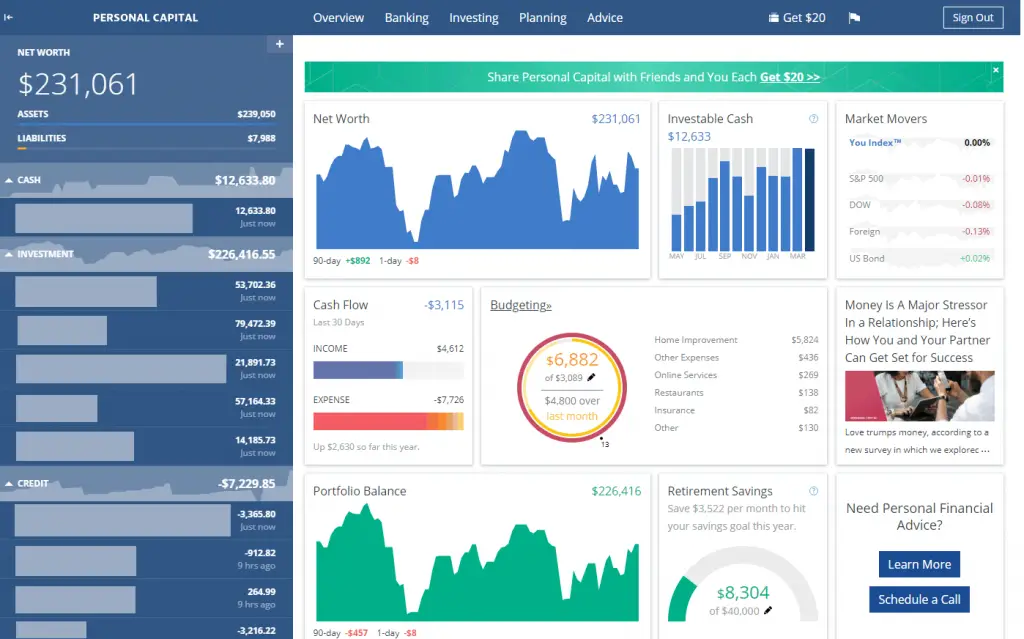

Personal Capital – Monitor All Your Investments

Personal Capital is a budgeting app that provides users with a comprehensive view of their finances, including investment portfolios, retirement planning, and spending analysis. The app is designed to help users track their expenses, set and stick to budgets, and make informed financial decisions.

The user experience is streamlined and user-friendly, with an intuitive dashboard that displays key financial metrics and interactive charts and graphs. Users can view their spending by category, monitor their net worth, and track their investments in real-time.

Personal Capital also offers personalized financial advice and investment recommendations based on the user’s financial goals and risk tolerance.

Overall, Personal Capital is a robust budgeting app that provides users with a powerful tool to manage their finances, track their spending, and plan for their financial future.

Availability: App available for iOS and Android.

👍Pros

- Comprehensive financial management: Personal Capital provides a complete view of a user’s finances, including spending, investments, and retirement planning, in one easy-to-use platform

- Investment tracking and analysis: The app offers robust investment tracking, with tools to monitor portfolios, analyze performance, and receive personalized investment recommendations

- Customized financial planning: Personal Capital provides users with customized financial planning, including retirement planning and investment planning, based on the user’s individual goals and risk tolerance

- User-friendly interface: The app’s dashboard is intuitive and easy to use, with interactive charts, graphs, and data visualization tools to help users understand their finances

- Personalized financial advice: Personal Capital offers personalized financial advice and investment recommendations, providing users with a comprehensive plan for their financial future

👎Cons

- Cost: Personal Capital is a premium budgeting app, with a higher cost than many other budgeting apps on the market

- Complexity: The app’s comprehensive financial management and investment tracking features may be too complex for some users, particularly those who are just starting to manage their finances

- Dependence on technology: As with all budgeting apps, Personal Capital requires users to have a reliable internet connection and device to access their financial information

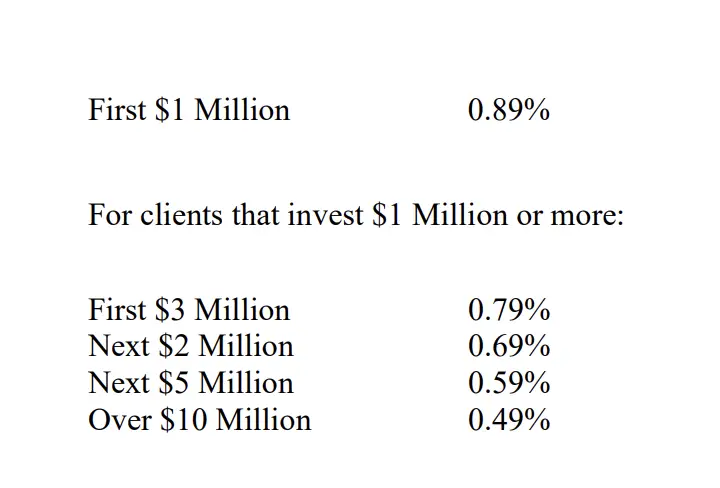

💸Pricing

- Basic version is free

- Premium version starts at an annual fee of 0.89% of assets under management

PocketGuard – Organize Your Expenses

PocketGuard is a budgeting app that offers a simple and intuitive solution for tracking expenses and managing personal finances. The app is designed to help users take control of their finances by providing a clear picture of their spending, income, and overall financial health.

The user experience is straightforward and easy-to-use, with a clean and modern interface that allows users to quickly and easily view their expenses, income, and budget in real-time.

PocketGuard categorizes spending automatically and provides alerts when users are approaching their budget limits, helping users stay on track and avoid overspending.

The app also offers features such as bill tracking and reminders, savings goals, and financial reports to help users stay organized and reach their financial goals.

Overall, PocketGuard is a budgeting app that provides users with a convenient and effective solution for managing their finances and reaching their financial goals.

Availability: App is available for both iOS and Android.

👍Pros

- Easy-to-use interface

- Automated spending categorization

- Budget tracking and alerts

- Bill tracking and reminders

- Savings goals

👎Cons

- Limited investment tracking

- Limited financial advice

- Dependence on technology

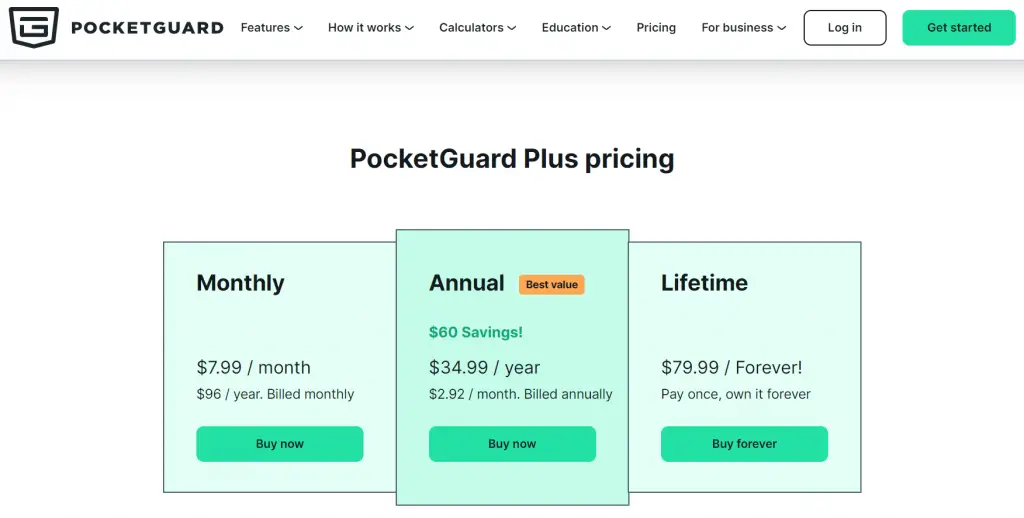

💸Pricing

- Basic version is free

- Premium version costs $4.99/month or $34.99/year

2 Best Budgeting Apps For Managing Expenses

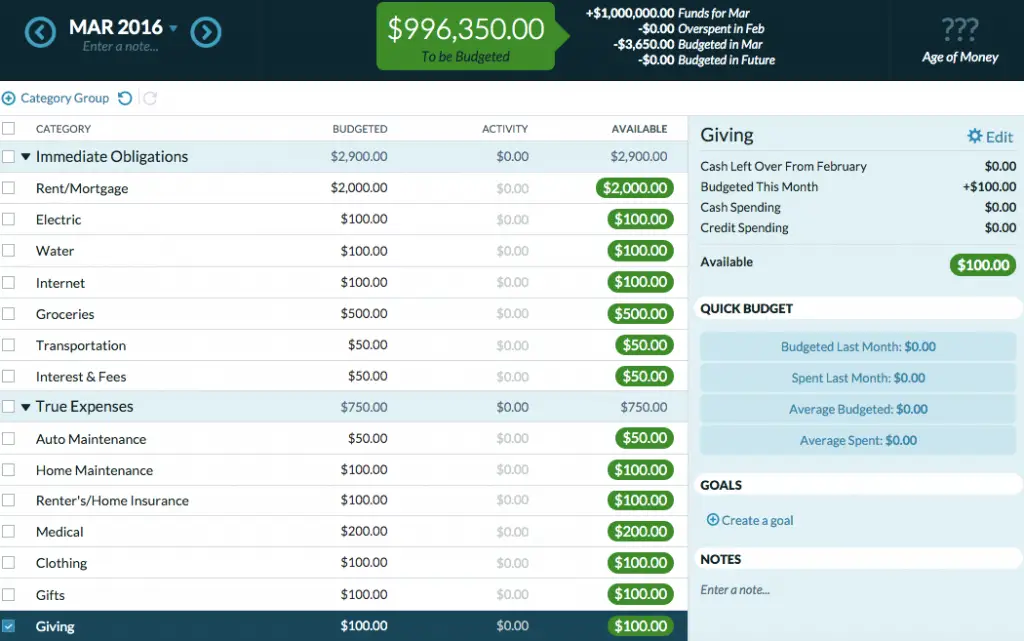

YNAB – Build Your Budget

YNAB (You Need A Budget) is a budgeting app that offers a unique approach to personal finance management. The app’s focus is on helping users take control of their money by creating a budget based on their actual income and expenses.

The user experience is designed to be simple, intuitive, and effective, with a clean and modern interface that makes it easy to track spending, set financial goals, and monitor progress.

YNAB also offers a range of educational resources, including a blog, podcasts, and webinars, to help users gain a deeper understanding of their finances and make informed decisions.

With its unique approach and focus on budgeting, YNAB is a budgeting app that provides users with a comprehensive solution for managing their finances and reaching their financial goals.

Availability: App is available for both iOS and Android.

👍Pros

- Unique budgeting approach: YNAB takes a unique approach to budgeting, focusing on creating a budget based on actual income and expenses, which helps users make informed financial decisions and stay on track

- Comprehensive budgeting tools: YNAB offers a range of budgeting tools, including the ability to track spending, set financial goals, and monitor progress, which provides users with a comprehensive solution for managing their finances

- Educational resources: The app provides a range of educational resources, including a blog, podcasts, and webinars, which helps users gain a deeper understanding of their finances and make informed decisions

- User-friendly interface: YNAB’s clean and modern interface is simple and intuitive, making it easy for users to track spending, set financial goals, and monitor progress

👎Cons

- Steep learning curve: While YNAB’s approach to budgeting is effective, it may have a steep learning curve for some users who are not familiar with budgeting or financial management

- Monthly subscription fee: YNAB requires a monthly subscription fee, which may be a drawback for some users who are looking for a budgeting app that is free or offers a free trial

- Limited investment tracking: YNAB is primarily focused on budgeting and does not offer investment tracking or portfolio management, which may be a drawback for some users

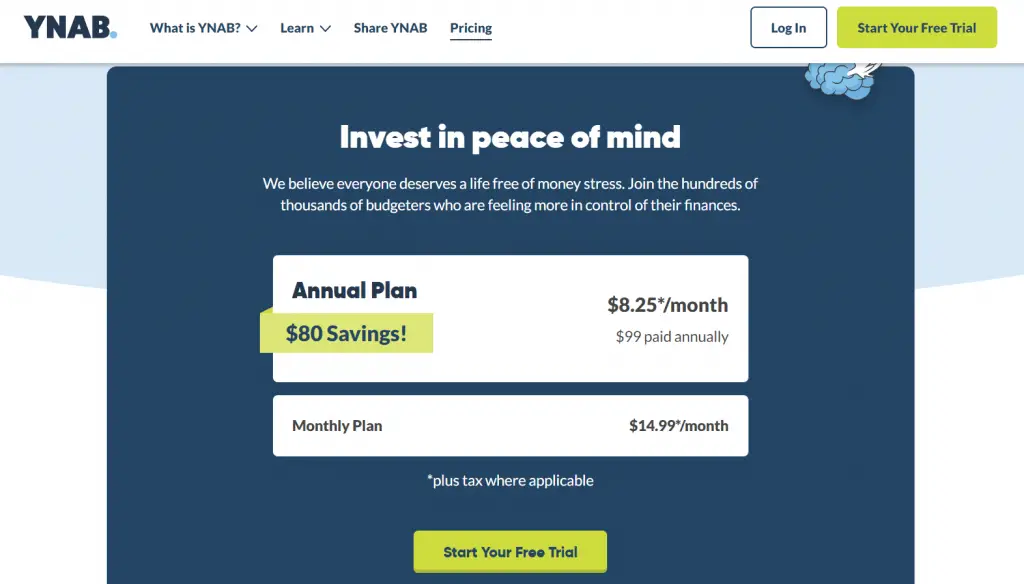

💸Pricing

- YNAB offers a 34-day free trial

- Two Premium plans:

- Annual plan: $99

- Monthly plan: $14.99

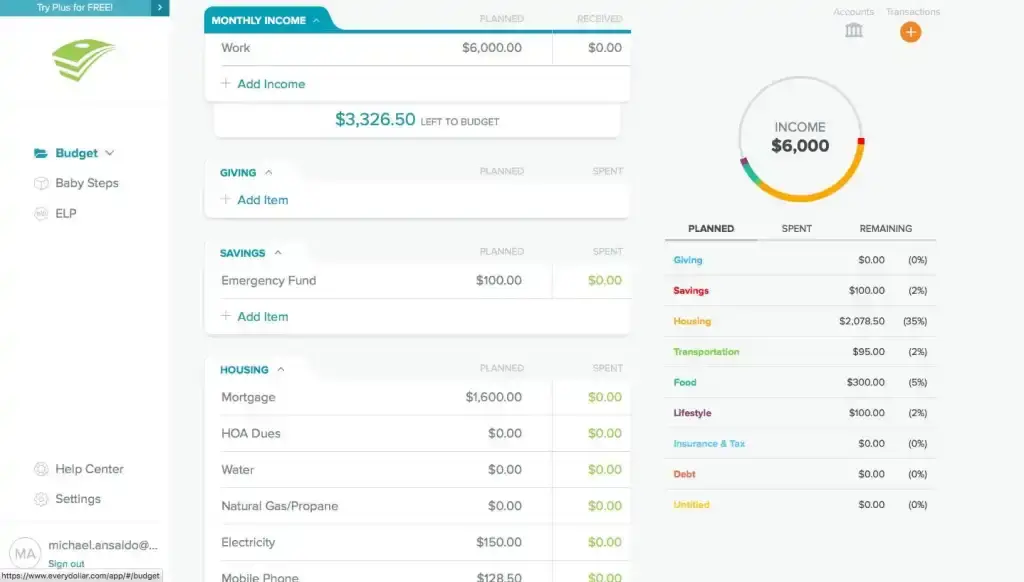

EveryDollar – Lets You Budget Anytime, Anywhere

EveryDollar is a budgeting app that aims to provide users with a simple and effective solution for managing their finances. The app offers an easy-to-use interface that allows users to create a budget and track their spending, as well as set and track financial goals.

The user experience is designed to be straightforward and straightforward, with a focus on helping users take control of their finances and make informed decisions.

EveryDollar offers a range of features and tools, including the ability to connect to bank accounts and categorize transactions, which provide users with a comprehensive solution for managing their finances.

With its focus on simplicity and ease of use, EveryDollar is a budgeting app that is ideal for those who are new to budgeting or who are looking for a straightforward and straightforward solution for managing their finances.

Availability: App is available for both iOS and Android.

👍Pros

- Simple and easy to use

- Comprehensive budgeting tools

- Connects to bank accounts

- Free version available

👎Cons

- Limited features in free version

- No investment tracking

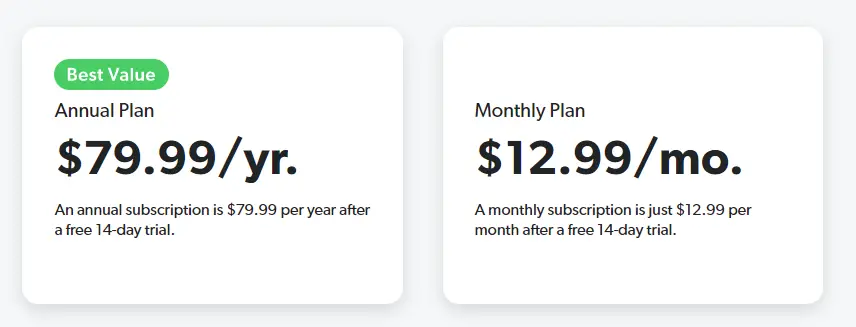

💸Pricing

- EveryDollar offers a free version as well as a paid premium version, which costs $12.99/month and $79.99/year

3 Prime Investment Tracking Apps For Monitoring Assets

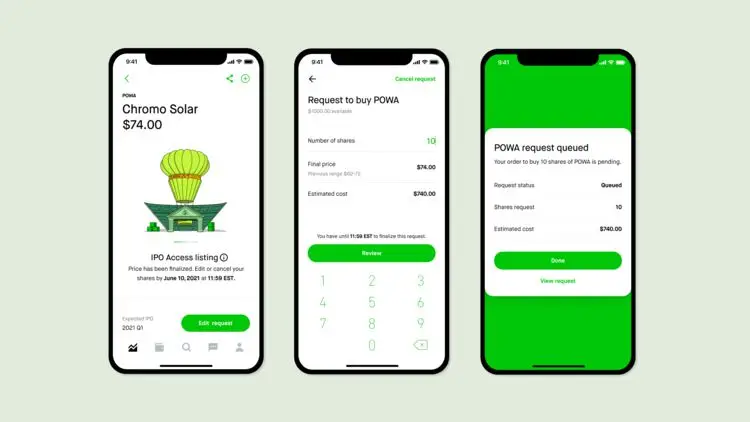

Robinhood – Shape Your Financial Future

Robinhood is a stock trading and investment app that provides a simple and user-friendly experience for buying and selling stocks and other financial products. The app features an intuitive and minimalistic interface, which makes it easy for users to track their investments and manage their portfolios.

Robinhood also offers commission-free trading, which makes it a popular choice among cost-conscious investors. Additionally, the app provides real-time market data and news, as well as educational resources to help users make informed investment decisions.

Overall, Robinhood provides a streamlined and accessible way for users to invest in the stock market.

Availability: App available on both the app store and google play store.

👍Pros

- Commission-free trading

- Easy to use interface

- Real-time market data

- Investment options

👎Cons

- Limited investment research tools

- No mutual funds or bonds

- Limited customer support

💸Pricing

- The first 30 days are free, then it’s only $5 a month

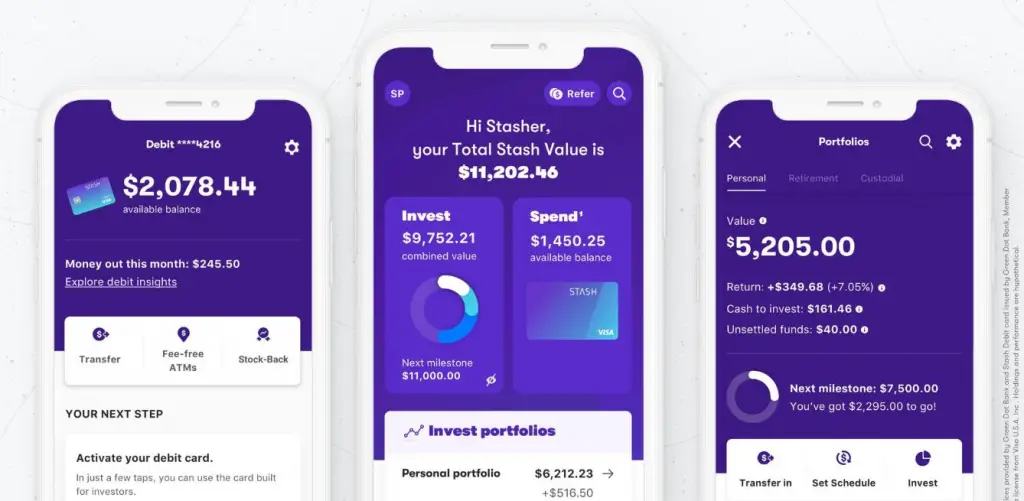

Stash – Save For The Future

Stash is a personal finance and investment app that provides a user-friendly experience for managing investments and saving money. The app is designed for new and novice investors and offers educational resources, including articles and videos, to help users learn about investing.

Stash also provides a range of investment options, including stocks, ETFs, and bonds, which can be easily managed through the app. The app’s interface is straightforward and intuitive, making it easy for users to track their investments and manage their portfolios.

Stash also offers features such as automatic investing, which allows users to automatically invest a set amount of money on a regular basis. Overall, Stash is a user-friendly app that provides a simple and accessible way for individuals to manage their investments and savings.

Availability: App available for Android and iOS devices.

👍Pros

- User-friendly design: Stash has a straightforward and intuitive interface that makes it easy for new and novice investors to manage their portfolios

- Investment options: Stash offers a range of investment options, including stocks, ETFs, and bonds, providing users with a variety of options for their portfolios

- Educational resources: Stash provides educational resources, including articles and videos, to help users learn about investing and make informed investment decisions

- Automatic investing: The app has an automatic investing feature that allows users to automatically invest a set amount of money on a regular basis

👎Cons

- Limited investment options: While Stash offers a range of investment options, the selection is still limited compared to other investment apps

- Higher fees than some other investment apps: Stash charges a monthly fee, which can be higher than some other investment apps that offer commission-free trading

- No tax-loss harvesting: Unlike some other investment apps, Stash does not offer tax-loss harvesting, a feature that helps investors minimize their taxes by offsetting capital gains with losses

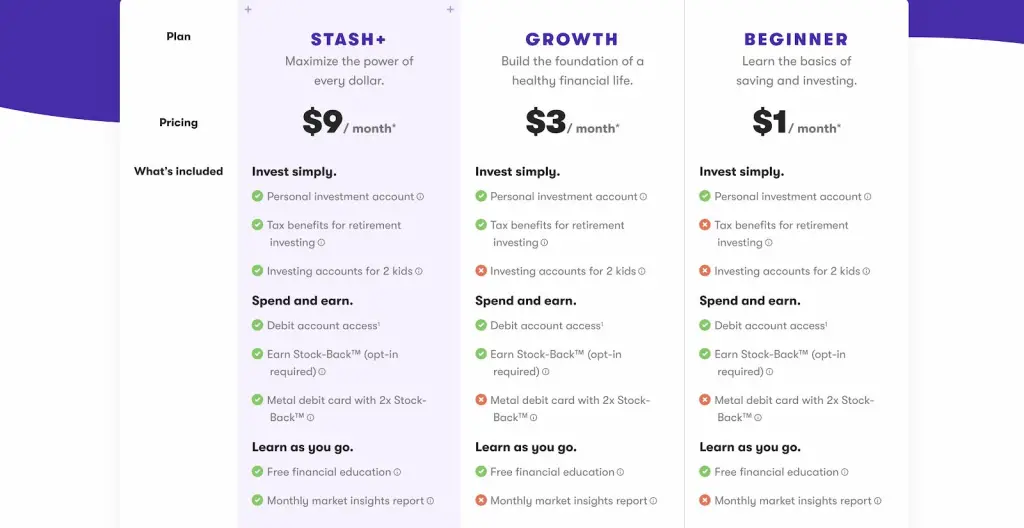

💸Pricing

- Growth version $3/month

- Stash+ version $9/month

Acorns – Save And Invest For Your Future

Acorns is a personal finance and investment app that provides an easy and automated way for users to invest their spare change. The app is designed for individuals who want to start investing but may not have a large amount of money to invest upfront.

Acorns automatically rounds up the purchases made with a linked debit or credit card to the nearest dollar and invests the spare change into a diversified portfolio of ETFs.

The app’s interface is simple and user-friendly, making it easy for users to track their investments and see the growth of their portfolios over time.

Additionally, Acorns provides educational resources, including articles and videos, to help users learn about investing and personal finance. Overall, Acorns provides a convenient and accessible way for individuals to start investing and grow their savings.

Availability: App is available only on the App Store for iPhone.

👍Pros

- Automated investing: Acorns automatically invests users’ spare change, making it easy for individuals to start investing with small amounts of money

- Diversified portfolio: The app invests users’ spare change into a diversified portfolio of ETFs, reducing the risk and increasing the potential returns of the investment

- User-friendly interface: The app has a simple and user-friendly interface that makes it easy for users to track their investments and manage their portfolios

- Educational resources: Acorns provides educational resources, including articles and videos, to help users learn about investing and personal finance

👎Cons

- Limited investment options: Acorns only invests in a limited number of ETFs, offering fewer options compared to other investment apps

- High fees for small balances: The fees charged by Acorns can be relatively high for individuals with small investment balances

- Limited research tools: Acorns does not provide as many research tools and resources for analyzing stocks and making investment decisions compared to other investment apps

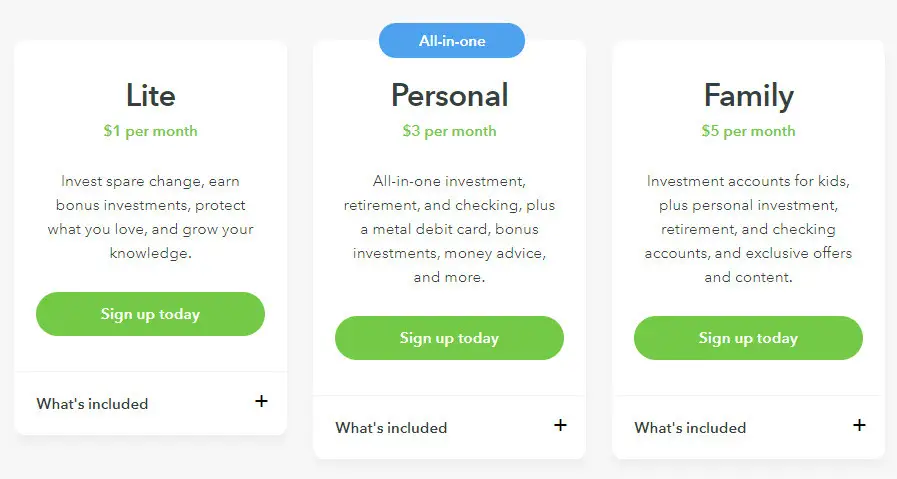

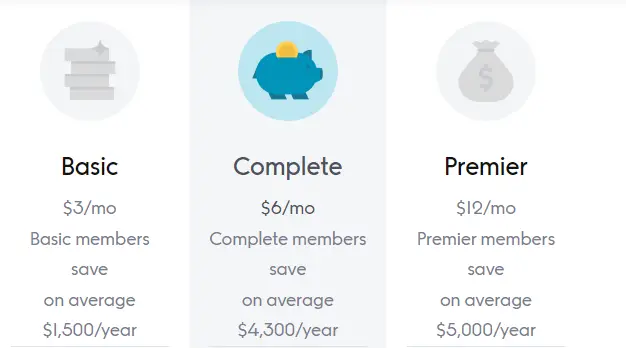

💸Pricing

- Personal version: $3/month

- Family version: $5/month

3 Topmost Debt Management Apps

Debt Payoff Planner – Plan And Track Your Payoff

Debt Payoff Planner is a financial tool that helps users manage and pay off their debt. The app provides a simple and user-friendly interface for users to input their debt information, including credit card balances, interest rates, and minimum payments.

Debt Payoff Planner then creates a customized debt repayment plan, which users can modify as needed. The app provides a visual representation of the debt repayment progress and helps users track their debt reduction over time.

Additionally, Debt Payoff Planner provides features such as reminders for monthly payments and helpful tips for reducing debt. Overall, Debt Payoff Planner is a convenient and effective tool for individuals looking to manage and pay off their debt.

Availability: App is available for Android and iOS devices.

👍Pros

- Customized debt repayment plan: Debt Payoff Planner creates a personalized debt repayment plan based on the user’s debt information, helping them stay on track with their debt repayment goals

- Debt tracking and visualization: The app provides a visual representation of the debt repayment progress, helping users track their debt reduction over time

- Reminders and tips: Debt Payoff Planner provides reminders for monthly payments and helpful tips for reducing debt, making it easier for users to stay on top of their debt repayment efforts

- User-friendly interface:

- The app has a simple and user-friendly interface, making it easy for users to input and manage their debt information

👎Cons

- Limited to debt repayment planning: Debt Payoff Planner only focuses on debt repayment planning, not on other aspects of personal finance management

- May not account for all debt: The app may not take into account all types of debt, such as student loans or medical debt, making it less comprehensive compared to other personal finance apps

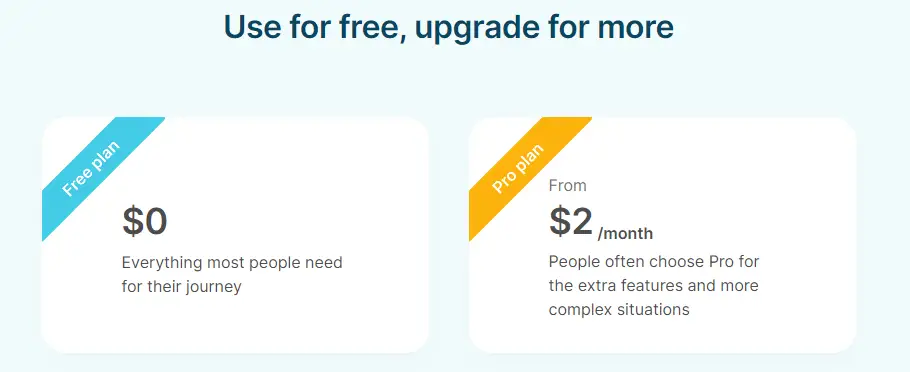

💸Pricing

- Pro plan starts at $2/month

Tally – Get Help With Your Credit Card Debt Payoff

Tally is a personal finance app that helps users manage their credit card debt. The app provides a simple and user-friendly interface for users to link and manage their credit cards.

Tally uses advanced technology to automatically monitor users’ credit card balances, interest rates, and due dates, and provides personalized recommendations for paying off debt.

Tally also offers a line of credit to eligible users, which they can use to pay off high-interest credit card debt and save money on interest. The app provides a clear overview of users’ credit card balances, payments, and savings, helping them stay on top of their debt repayment efforts.

Overall, Tally provides a convenient and effective solution for individuals looking to manage and pay off their credit card debt.

Availability: App is available for Android and iOS devices.

👍Pros

- Automated credit card management: Tally automatically monitors users’ credit card balances, interest rates, and due dates, making it easier for users to stay on top of their debt repayment efforts

- Personalized recommendations: Tally provides personalized recommendations for paying off debt, helping users save money on interest and pay off their debt more efficiently

- Line of credit: Tally offers a line of credit to eligible users, which they can use to pay off high-interest credit card debt and save money on interest

- Clear overview of debt repayment: The app provides a clear overview of users’ credit card balances, payments, and savings, helping them track their debt repayment progress over time

👎Cons

- Eligibility criteria for line of credit: Not all users may be eligible for the Tally line of credit, which may limit its availability to some individuals

- Potential impact on credit score: Using a line of credit from Tally could potentially impact users’ credit scores, depending on various factors such as payment history and credit utilization

💸Pricing

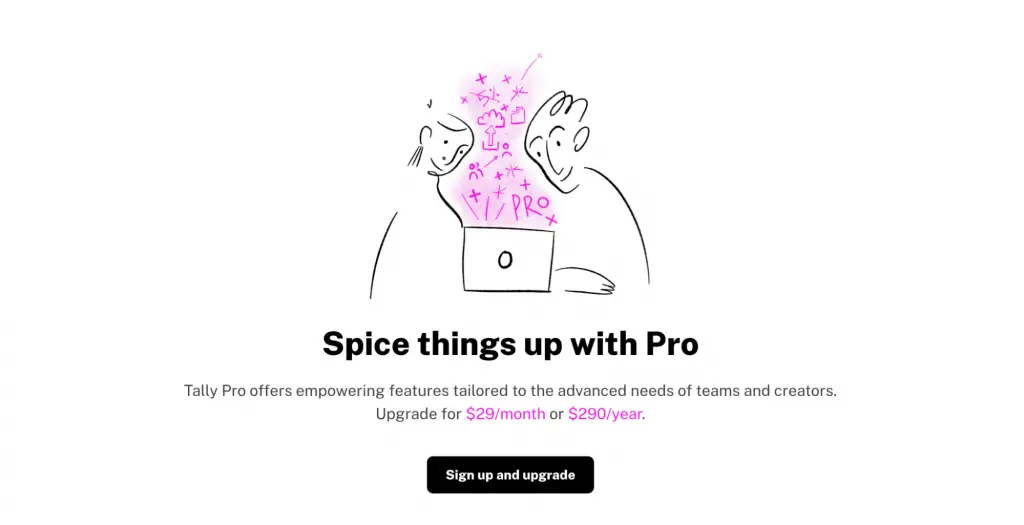

- Tally charges a fee for its line of credit and credit card management services

- $29/month

- $290/year

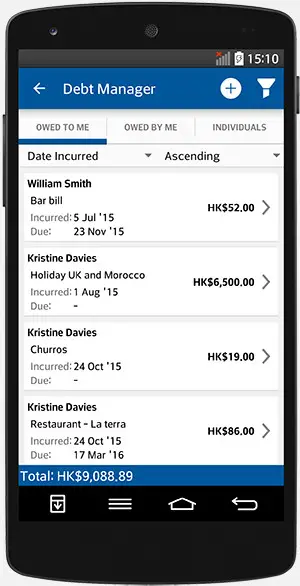

Debt Manager – Organize, Track And Pay Off All Your Debts

Debt Manager is a financial tool that helps users manage and pay off their debt. The app provides a simple and user-friendly interface for users to input their debt information, including credit card balances, interest rates, and minimum payments.

Debt Manager then creates a customized debt repayment plan, which users can modify as needed. The app provides a visual representation of the debt repayment progress and helps users track their debt reduction over time.

Additionally, Debt Manager provides features such as reminders for monthly payments and helpful tips for reducing debt. Overall, Debt Manager is a convenient and effective tool for individuals looking to manage and pay off their debt.

Availability: App is available for Android and iOS devices.

👍Pros

- Customized debt repayment plan

- Debt tracking and visualization

- Reminders and tips

- User-friendly interface

👎Cons

- Limited to debt repayment planning: Debt Manager only focuses on debt repayment planning, not on other aspects of personal finance management

- May not account for all debt

💸Pricing

- Debt Manager app is priced as $0.99

3 Reliable Saving and Goal Tracking Apps For Academics

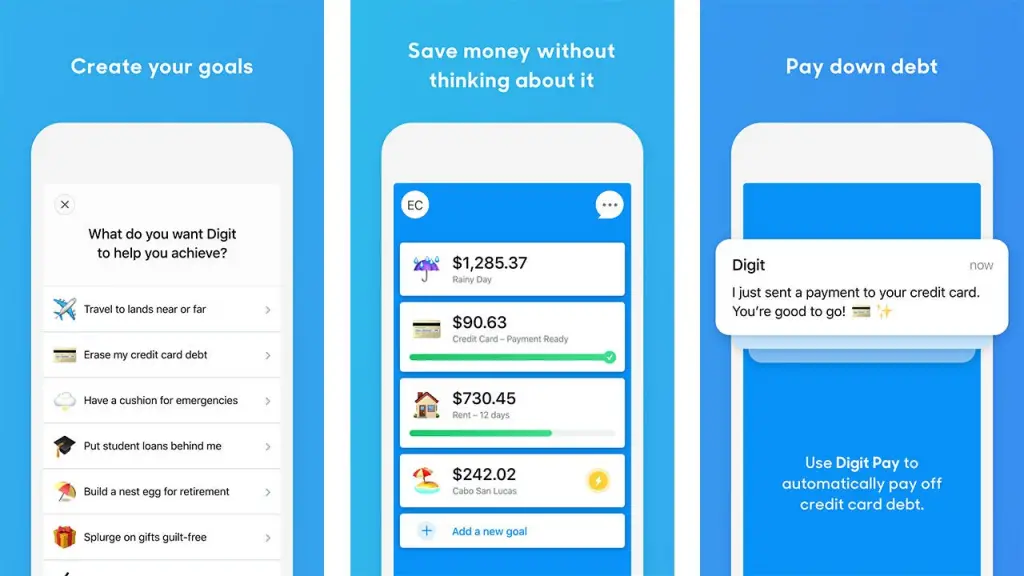

Digit – Reach Financial Freedom

Digit is a personal finance app that helps users save money automatically. The app uses advanced algorithms to analyze users’ spending patterns and automatically transfers small amounts of money from their checking account into savings accounts with Digit.

Users can set savings goals and track their progress, and they can also withdraw their savings at any time. The app provides a simple and user-friendly interface, and users receive daily updates on their savings progress via text message.

Overall, Digit provides a convenient and automatic solution for individuals looking to build their savings and reach their financial goals.

Availability: App is available for Android and iOS devices.

👍Pros

- Automated savings: Digit automatically transfers small amounts of money from users’ checking accounts into a savings account, making it easy for users to build their savings without having to manually transfer funds

- Customizable savings goals: Users can set savings goals and track their progress, helping them stay motivated and on track with their financial goals

- Easy access to savings: Users can withdraw their savings at any time, giving them easy access to their money when they need it

- User-friendly interface: Digit provides a simple and user-friendly interface, making it easy for users to manage their savings and track their progress

👎Cons

- Limited to savings management

- Potential impact on checking bank account balance

💸Pricing

- Digit charges a monthly fee of $5 for its savings management services after a free 6-month trial according to their FAQs

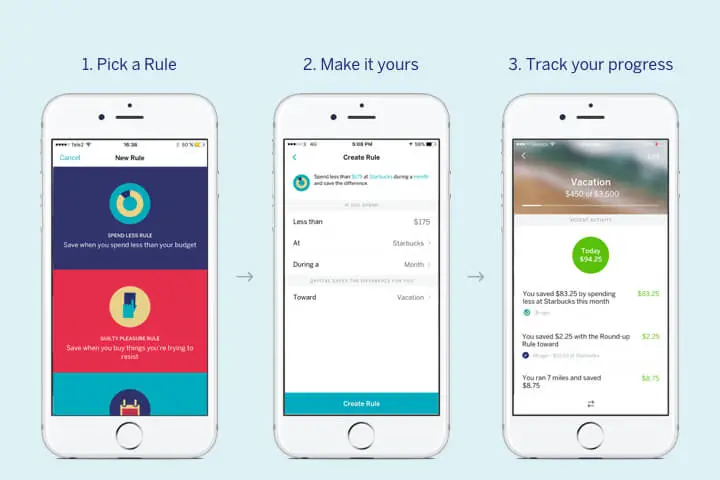

Qapital – Discover True Money Happiness

Qapital is a personal finance app that helps users save money and reach their financial goals. The app allows users to set custom savings goals, such as saving for a down payment on a house or a vacation, and then automates savings transfers to help them reach their goals.

Users can also create custom “Rules,” such as rounding up purchases to the nearest dollar and transferring the difference to savings, to help them save money effortlessly. Qapital provides a simple and user-friendly interface for users to manage their savings and track their progress.

Additionally, the app offers investment options for users who want to grow their savings and reach their financial goals faster. Overall, Qapital provides a comprehensive and convenient solution for individuals looking to manage their savings and reach their financial goals.

Availability: App is available for Android and iOS devices.

👍Pros

- Qapital automates savings transfers to help users reach their financial goals, making it easy for them to build their savings without having to manually transfer funds

- Customizable savings goals: Users can set custom savings goals, such as saving for a down payment on a house or a vacation, and track their progress, helping them stay motivated and on track with their financial goals

- Investment options: In addition to savings management, Qapital offers investment options for users who want to grow their savings and reach their financial goals faster

- User-friendly interface: Qapital provides a simple and user-friendly interface, making it easy for users to manage their savings, track their progress, and make investments

👎Cons

- Limited investment options: While Qapital offers investment options, they may be limited compared to other investment apps or traditional investment platforms

- Monthly fee: Qapital charges a monthly fee for its services, which may not be cost-effective for all users depending on their savings and investment habits

💸Pricing

- Qapital charges a monthly fee for its services, which starts at $3 per month for the basic savings and budgeting plan and increases to $6 per month for the premium plan

Acorns Later – Easily Manage Your Investments

Acorns Later Review: Retire with Acorns Invest App

Acorns Later is a retirement savings app that is part of the Acorns family of personal finance products. The app provides an easy and convenient way for users to save for retirement by automatically investing their spare change and rounding up their purchases to the nearest dollar.

Acorns Later offers a variety of investment portfolios to suit different risk tolerance levels and financial goals, and users can easily manage their investments and track their progress through the app’s user-friendly interface.

In addition to investment management, Acorns Later provides educational resources and tools to help users understand the importance of saving for retirement and make informed investment decisions.

Overall, Acorns Later is designed to help users build their retirement savings with minimal effort, making it a convenient and accessible option for individuals looking to secure their financial future.

Availability: App is available for Android and iOS devices.

👍Pros

- Acorns Later automates savings by investing spare change and rounding up purchases, making it easy for users to build their retirement savings without having to manually transfer funds

- Investment options: The app offers a variety of investment portfolios to suit different risk tolerance levels and financial goals, providing users with a range of investment options to choose from

- User-friendly interface: Acorns Later provides a simple and user-friendly interface for users to manage their investments and track their progress, making it easy to stay on top of their retirement savings

- Educational resources: In addition to investment management, Acorns Later provides educational resources and tools to help users understand the importance of saving for retirement and make informed investment decisions

👎Cons

- Limited investment options: While Acorns Later offers a variety of investment portfolios, they may be limited compared to other investment apps or traditional investment platforms

- Market risk: Like all investments, the portfolios offered through Acorns Later are subject to market risk and may fluctuate in value, so it’s important for users to consider this risk when making investment decisions

- Monthly fee: The app charges a monthly fee for its services, which may not be cost-effective for all users depending on their savings and investment habits

💸Pricing

- Acorns Later charges a monthly fee for its services, which starts at $1 per month for the basic plan and increases to $3 per month for the premium plan, which includes additional features and investment options

Budgeting Apps Features to Look For

When looking for the best budgeting apps for academics, there are a few key features to consider:

- Expense tracking: The ability to track expenses, categorize spending, and view the data in easy-to-read charts and graphs.

- Budget creation: The ability to create a budget, set limits for various spending categories, and track progress towards budget goals.

- Financial account integration: The ability to connect and automatically import transactions from bank accounts, credit cards, and other financial investment accounts.

- Bill reminders: The ability to set reminders for upcoming bills, so users never miss a payment.

- Investment tracking: The ability to track investments and monitor portfolio performance, including stocks, mutual funds, and other investments.

- Debt management: The ability to track debt, including credit card balances and loans, and create a plan to pay it off.

- Saving and goal tracking: The ability to track savings and set goals for the future, such as a down payment on a house or a trip.

- Personalized insights and resources: The ability to receive personalized insights and financial advice, such as alerts for overspending or tips for improving finances.

- User-friendly interface: An intuitive and easy-to-use interface, making it simple for users to track their spending and manage their finances.

- Mobile compatibility: The ability to use the app on a smartphone or tablet, so users can manage their finances on-the-go.

Pros and Cons of Using Budgeting Apps

Pros:

- 👍Increased awareness of spending: Budgeting apps help users become more aware of their spending habits, including where their money is going and where they may be overspending.

- 👍Improved budgeting and savings: By tracking expenses and setting budgets, users can make more informed decisions about their finances, saving more money and reaching their financial goals.

- 👍Automated financial tracking: Budgeting apps automate the tracking of expenses and income, making it easier for users to stay on top of their finances.

- 👍Personalized insights and advice: Many budgeting apps provide users with personalized insights and advice, such as tips for reducing expenses or improving their credit score.

- 👍Access to financial information at all times: Budgeting apps are accessible from anywhere, at any time, providing users with a complete overview of their finances at their fingertips.

Cons:

- 👎Security concerns: Budgeting apps require users to provide sensitive financial information, and there is always a risk of this information being hacked or stolen.

- 👎Potential for errors: While budgeting apps automate much of the financial tracking process, there is still the potential for errors, such as incorrect categorization of expenses.

- 👎Dependence on technology: Budgeting apps rely on technology, and if there are issues with the app or the user’s device, they may not be able to access their financial information.

- 👎Cost: Some budgeting apps may require a subscription fee, while others offer a limited set of features for free but charge for premium features.

Final Thoughts

In conclusion, budgeting apps can be a valuable tool for academics looking to take control of their finances and reach their financial goals.

With so many options available, it’s important to choose the best budgeting app that offers the features that are most important to you, and fits with your individual financial needs and goals.

From the ability to track expenses, categorize spending, and view data in easy-to-read charts and graphs, to personalized insights and financial advice, budgeting apps offer a range of benefits for academics.

However, it’s important to be aware of the potential security concerns, the risk of errors, and the dependence on technology when using these apps. It’s also important to consider the cost of the app and to choose one that offers a good balance between features and cost.

Ultimately, the decision to use a budgeting app is a personal one, and it’s important to find one that works best for you. Whether you’re just starting out on your financial journey or looking to improve your existing budgeting habits, there’s a budgeting app that can help.

If you’re already using a budgeting app, we encourage you to share your experiences in the comments below, and help others who are considering using one to make an informed decision.